Project:

Saving time for mortgage brokers

Position:

In-house UX designer for My Local Broker

Activities:

User research, Competitive analysis, Wireframing, Design, Prototyping, Usability testing, Analytics, Service blueprint

Year:

2016 - 2017

Background

My Local Broker aims to connect mortgage brokers with customers looking for a home loan, to refinance, or to invest in property. Its aggregation business, My Local Aggregation helps mortgage brokers grow their business with a full suite of marketing tools and Chief, the tech-driven software platform created by brokers, for brokers.

Its value proposition is to save time for brokers in their day-to-day job, giving them more time to build relationship with their customers.

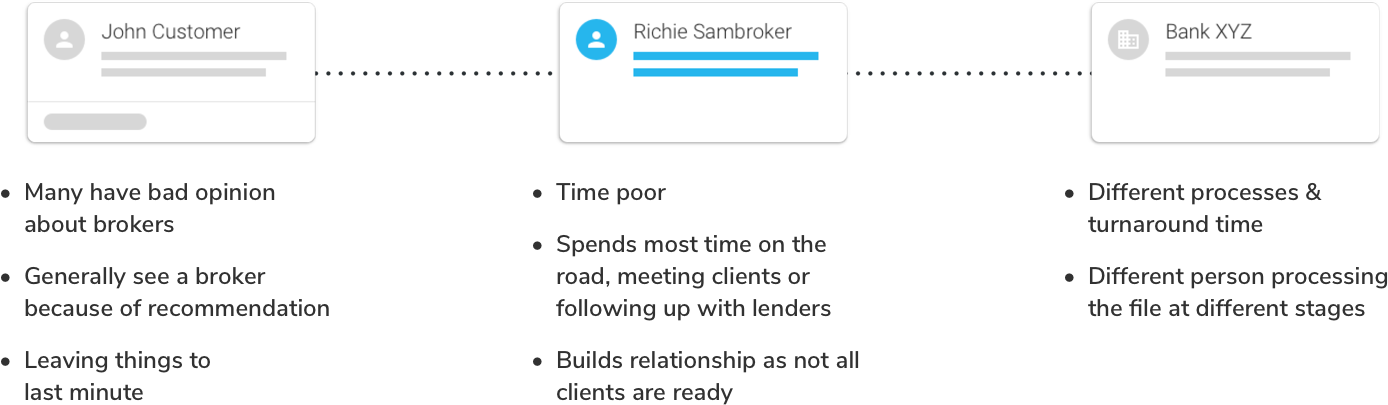

Understanding Mortgage brokers

Brokers are time poor, spends most of their time on the road. Some brokers may be perceived negatively due to the sales nature of the job and generally potential customers only seek after their services after they exhausted their options with the banks directly. Thus, a big percentage of what a broker does involves difficult or complex financial situation and much less of mom & pop vanilla deals.

My role

As a UX Designer, I carried out user research (broker interviews, contextual enquiry), wireframing, prototyping, hi-fidelity design and usability testing with mortgage brokers. I worked collaboratively with other designers, developers and other stakeholders in designing various aspects of Chief.

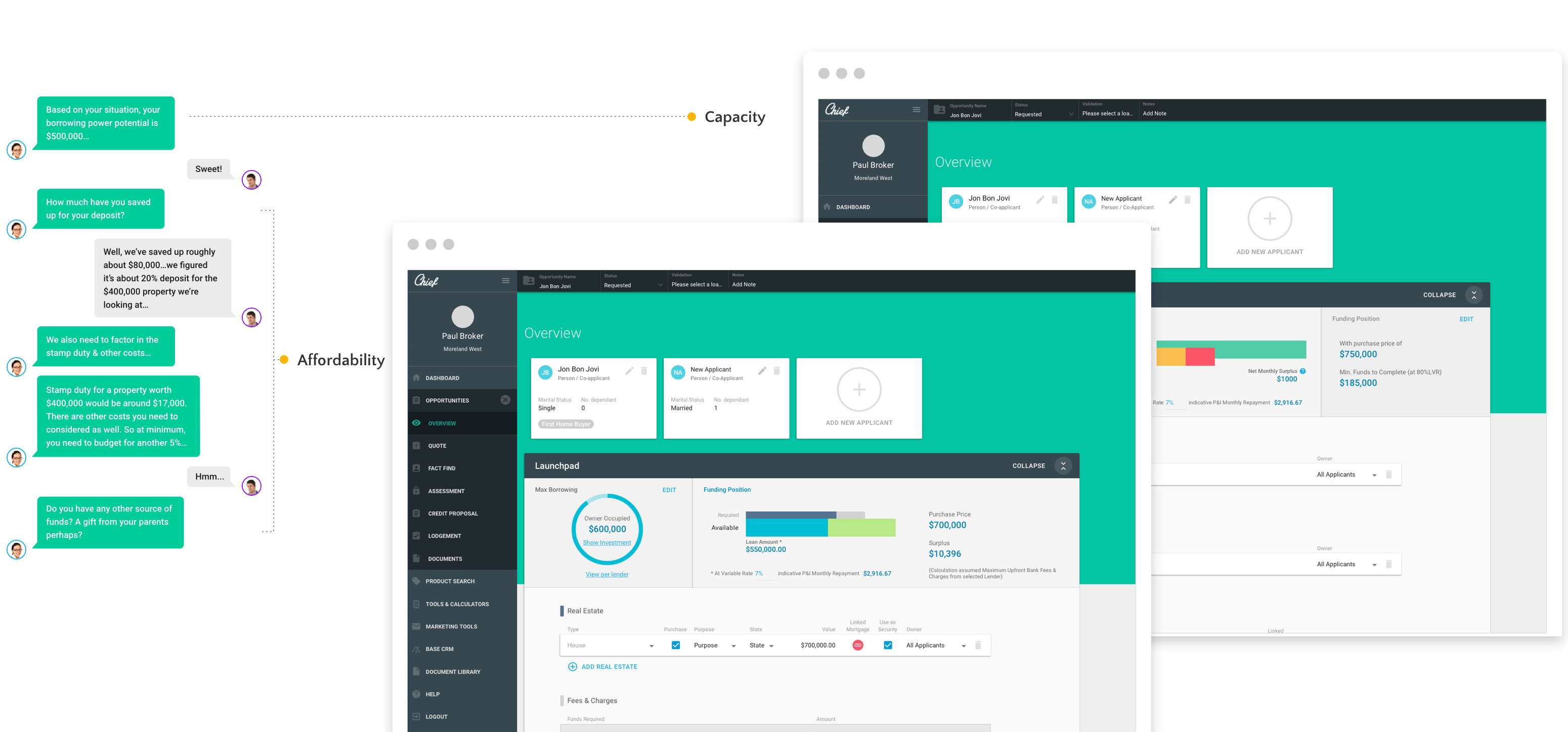

Launchpad

A Quick Assessment calculator

Mortgage brokers need to qualify their leads & the likelihood of them proceeding with an application, without spending too much time in the process. That means working out if they have the capacity to borrow & if they could afford to buy the property they want.

Launchpad is a quick assessment calculator which provides:

- Customers' borrowing power potential based on their situation

- And also works out their funds position, whether they have sufficient funds to meet the property settlement.

The benefits of making this calculator available for brokers are:

- It helps them quickly qualify 'leads' and determine whether they could proceed with a loan application or not without spending too much time in the process.

- At the same time, the calculator is able to provide an accurate result that's more meaningful for brokers, thanks to API services based on lenders' requirements & lending policies.

This is a big shift from generic calculators available in the market, or the 'back of a napkin' calculation (ballpark figure) that brokers often do. - The information that the broker gathers in the calculator also feeds through the loan application, so the broker doesn't have to start everything from scratch.

The calculator also became a much needed selling point as requested feature before brokers considered onboarding with My Local Broker.

Competitive analysis

I initially looked at other calculators available in the market, which were either too generic of lender specific, I also analysed the data requirements from the API service to produce a borrowing power calculation. This includes understanding lenders' policy requirements that may affect the result.

Design, prototype & build

In the early stages, I built Axure prototypes to test whether to have borrowing power & funds position on the same page or not. The prototypes had basic mathematical functionalities to spit out these calculations as the user input his/her financial data. While rudimentary in function, the prototypes helped with design direction to separate the metrics.

The design was refined further after feedback from brokers and developers. The UI for Launchpad went through several iterations till it arrived to the final version as per below. Working closely with developers during build phase & testing phase was also critical in ensuring calculation results are accurate.

Next step

The calculator was very well received by brokers. Seeing how the calculator helps them in their day-to-day operation they also requested for PDF report functionality to be made available of Launchpad.

Other works

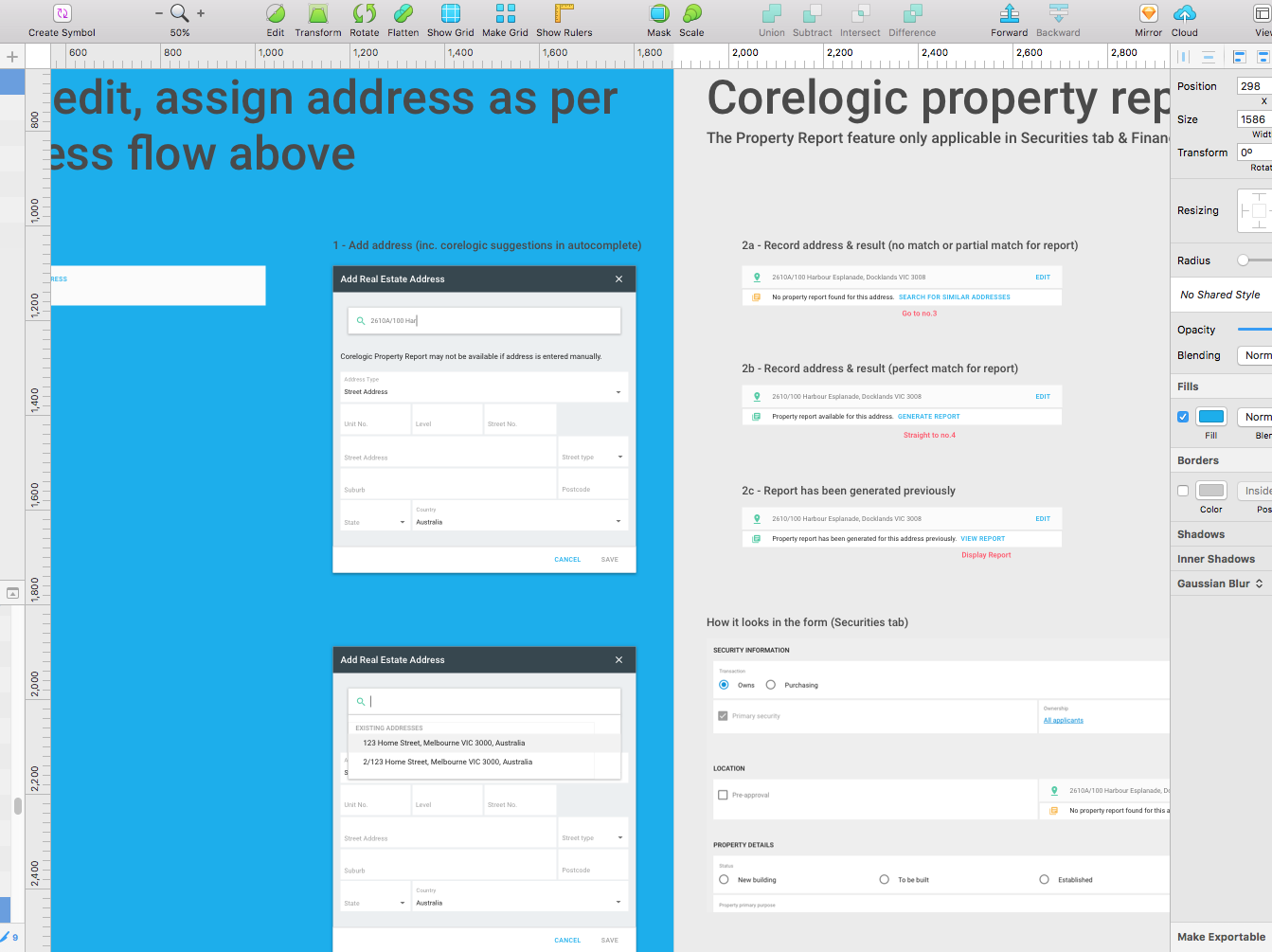

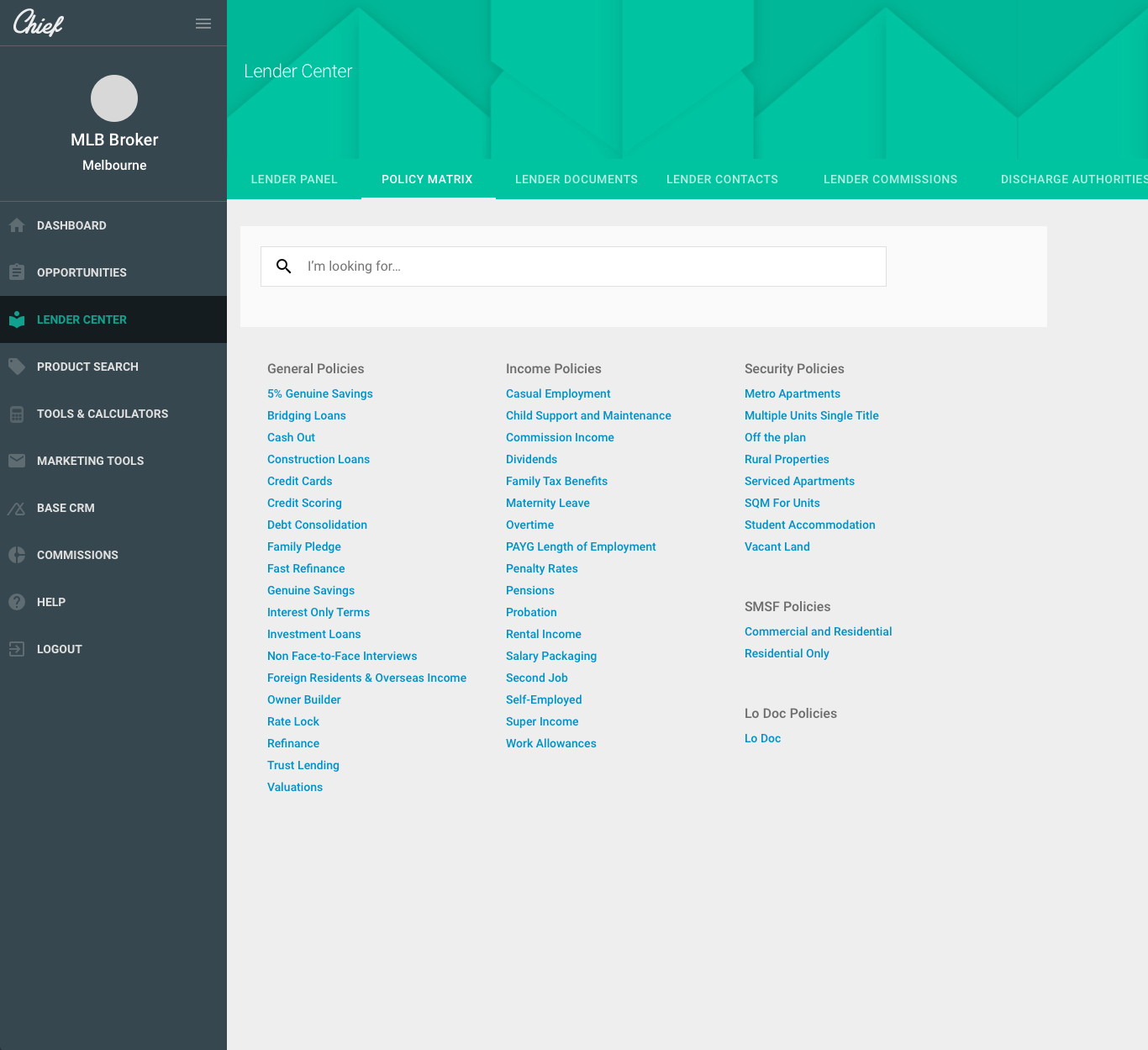

Third party service integrations

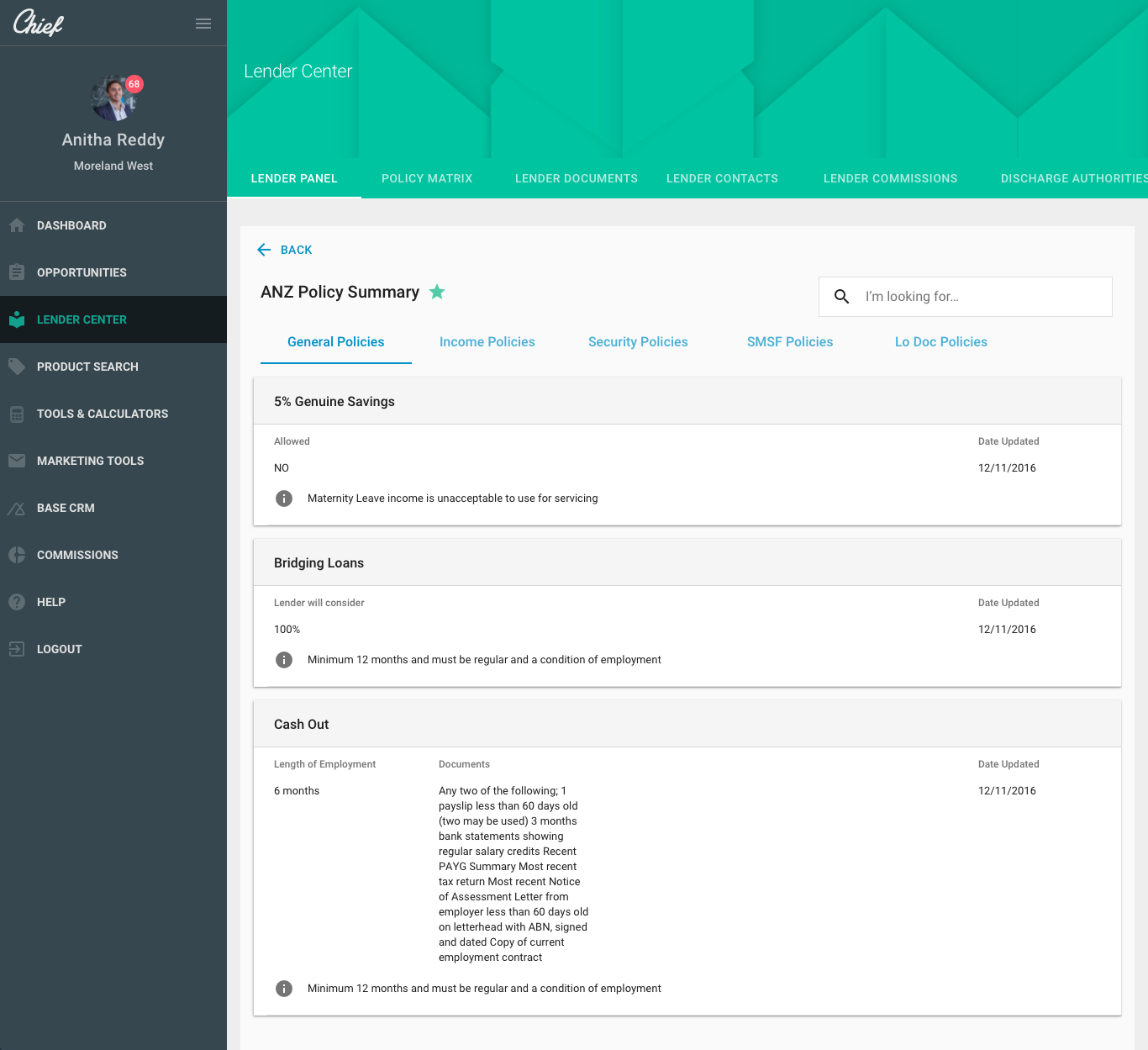

Some of the third party service integrations that I worked on was Corelogic Property report service, Veda credit check and Lender policy matrix. These services are available to the broker's disposal through Chief.

Mapping out Broker onboarding process

Aside from the products, I also did process mapping (not to dissimilar to a Service blueprint) for the brokers on-boarding process. This work was to identify process steps in broker on-boarding, looking at what was happening with Sales & BDM (front house) and Support team & external parties (back house). The outcome was used to highlight where the onboarding process is doing well & where it needs improvement.